EXTRACT FROM THE PROCEDURE FOR CONSIDERING CONSUMER APPEALS

Extract from the Procedure for considering the appeals of consumers of banking services to Kompanion Bank CJSC

I. GENERAL PROVISIONS

1. The procedure for considering the appeals from consumers of banking services (hereinafter referred to as the Procedure) in Kompanion Bank CJSC (hereinafter referred to as the Bank) has been developed in accordance with the law of the Kyrgyz Republic (hereinafter referred to as the KR) and regulatory legal acts of the National Bank of the Kyrgyz Republic (hereinafter referred to as the NBKR), the principles of consumer protection in accordance with the recommendations of Smart Campaign and local regulations of the Bank.

2. The procedure has been developed in order to coordinate work with the Bank's banking services consumers, analyze, evaluate the quality of service and the degree of customer satisfaction, as well as improve the quality of banking products.

3. This Procedure is mandatory for all employees of the Bank working with consumers.

4. When providing banking services and considering consumer complaints, Bank employees should be guided by the following basic principles:

a. legality, honesty, integrity, transparency, reasonableness, fairness, social responsibility;

b. respect and protection of the rights and legitimate interests of consumers, cooperate with them;

c. considering appeals and providing the results of their consideration;

d. timeliness, objectivity and completeness when considering appeals;

e. equality of consumers when considering appeals;

f. ensuring the safety and non-disclosure of information constituting a bank secrecy.

5. Considering consumer complaints by the Bank is free of charge. The Consumer may not be limited in the ability to apply to the Bank with an appeal. Refusal to accept appeals is not allowed.

III. APPEAL PROCEDURE

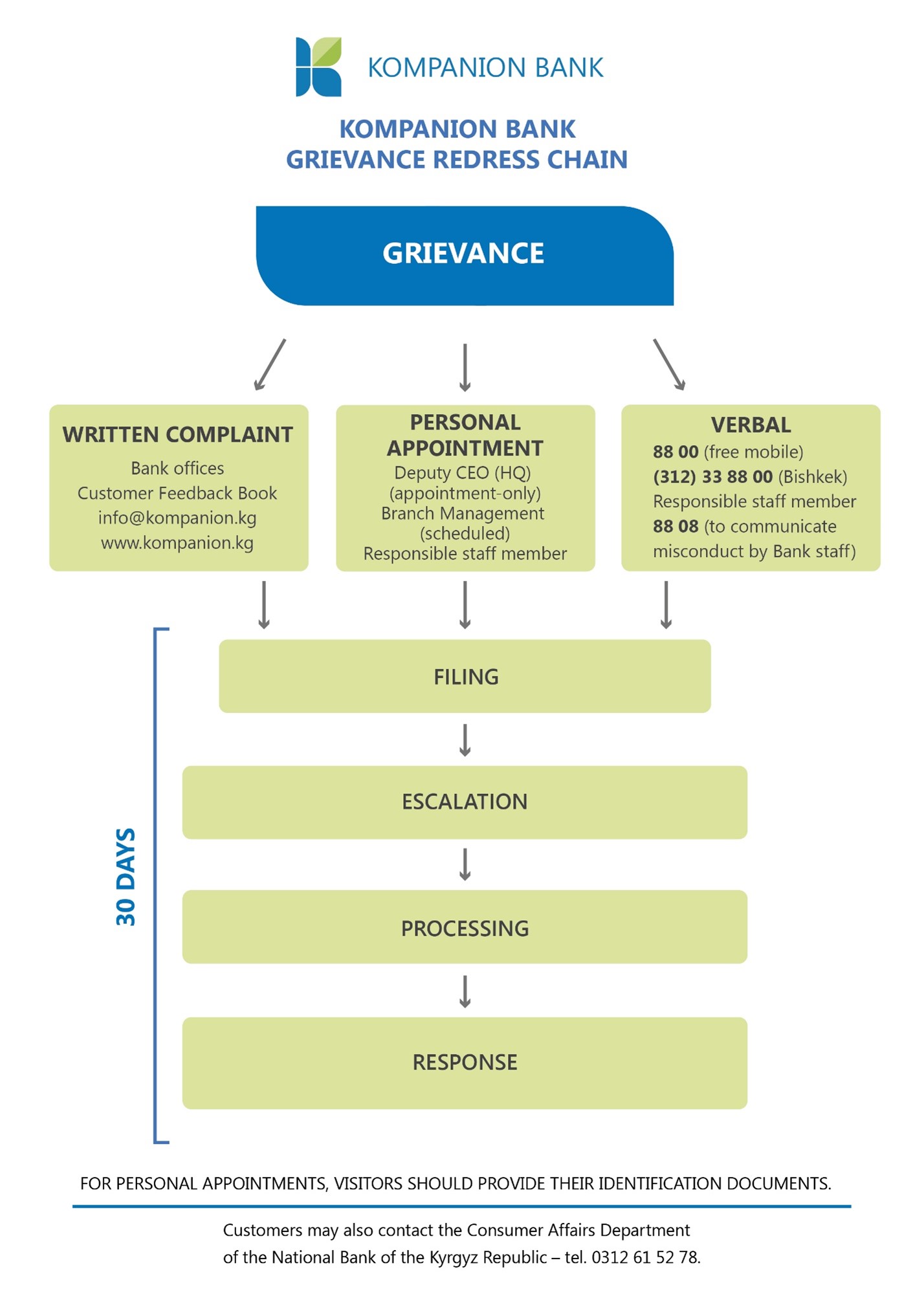

1. The Bank provides the consumer with a wide range of communication channels for submitting applications. The Consumer has the right to:

a. apply in writing at branches, savings banks, at the Head Office of the Bank.

b. send his appeal in electronic form via the Internet or fill out a feedback form on the

Bank's website (www.kompanion .kg);

c. provide information at 8800 (free call from mobile), (312) 33 88 00;

d. send message to the Bank's WhatsApp number: +996 770 338800;

e. make suggestions to the Bank employee,

f. leave an entry in the Book of Complaints and Suggestions;

g. apply for a personal meeting with the Head of the Bank or the Director of the branch. The reception is carried out during the Bank's working hours, in accordance with the approved schedule posted on the website and/or on the information stand.

2. When the consumer submits a written application, it must contain at least:

• personal (full name) and contact details (phone, postal and/or email address, etc.);

• the date of the event that led to the submission of the application;

• the essence of the application;

• date of submitting the application;

• signature of the consumer who submitted the application/ filled out the Book of complaints and suggestions (except for applications received electronically);

• client number/account number (preferably, but not necessarily).

- Written applications of the consumer that do not contain personal and contact details, as well as the postal address to which the response should be sent to the applicant, are recognized as anonymous and are not subject to consideration. A written application from a consumer containing obscene or offensive expressions, threats to the life, health and property of a Bank employee, as well as members of his family are not subject to consideration.

- Repeated consumer applications, in which new arguments or circumstances are not given, may be left without consideration, provided that exhaustive answers have been given to previous applications and all necessary measures have been taken.

- Consumer applications are considered no later than 30 (thirty) calendar days from the date of receipt.

- The response to the consumer's applications concerning the provision of banking services is signed by an authorized person of the Bank. The response to the consumer based on the results of the review is given in the language of the application — the state or official (Kyrgyz or Russian) language of the Kyrgyz Republic.

- The response to the consumer's application is sent by registered mail with a notification of receipt, or by e-mail (if the consumer has indicated this channel as the most desirable for receiving feedback), or is delivered personally to the applicant. It is possible to use several ways to send a response at the same time. If several consumers have applied to the Bank in writing (a collective appeal), the response is sent to the address indicated in the application first, unless otherwise indicated in the application itself.

- If a written response was sent to an application from the Book of Complaints and Suggestions (at the request of the consumer), then a note is made in the Book of Complaints and Suggestions about sending a response in writing, indicating the number of the outgoing letter and the date of dispatch.

- If the consumer does not require a written response to the application left in the Book of Complaints and Suggestions, i.e. the consumer does not require a written response in his application, then the responsible employee of the branch/branch director informs the consumer by phone about the results of considering the application and determines how satisfied the consumer is with the response provided and makes a corresponding note in the Complaint Book.

- Applications in the complaint books made as proposals for improving the equipment of the office, are considered without providing a response to the consumer. Information about the measures taken is reflected in the Complaint Book in the section "Measures taken".

- The note on the measures taken to address consumers from the Book of Complaints and Suggestions is reflected by the responsible employee of the branch directly in the Book of Complaints and Suggestions (Appendix No. 1).

- If the application contains issues, the consideration of which is not within the competence of the Bank, the consumer is given an explanation about further application to other bodies in the appropriate manner.

VI. THE PROCEDURE FOR RECEIVING AND CONSIDERING COMPLAINTS ABOUT ILLEGAL ACTIONS OF THE BANK'S EMPLOYEES

1.The bank has opened a hotline (phone number 8808) to receive oral appeals from consumers about illegal actions on the part of Bank employees or suspicion of such actions.

A call from mobile phones to this short number is free for consumers.

2. In the event of questionable actions, transactions on the part of the Bank's employees, the consumer can file a complaint both in writing and orally

VIII. CONFIDENTIALITY

1. All information received by responsible employees of the Bank, including in the form of responses to requests to state authorities, local self-government or other organizations during the consideration of appeals, is confidential information, except for information reflected in the Book of Complaints and Suggestions, due to its public availability.